Bitcoin Signal - meet my BTC models

1. Bitcoin Fair Model - the “fair zone” of price

A dynamic corridor with upper/lower fair bands and a midline. It answers: “Are we discount, normal, or premium vs current vol and flow regime?”

On the chart:

Fair Value range (High/Low) + midline.

BUY tags print when price hits/sub-breaks the lower fair band in contexts where mean-revert odds are elevated.

A compact panel shows nearby references to plan entries/exits.

How to use:

With a bullish macro regime (see Macro Index), buy pullbacks into the lower half; trim near the mid/upper band.

In neutral/bearish backdrops, sell premium at the upper band; only take aggressive longs at the lower edge.

It won’t “call the day’s high”- it gives context: are we rich or cheap for these conditions.

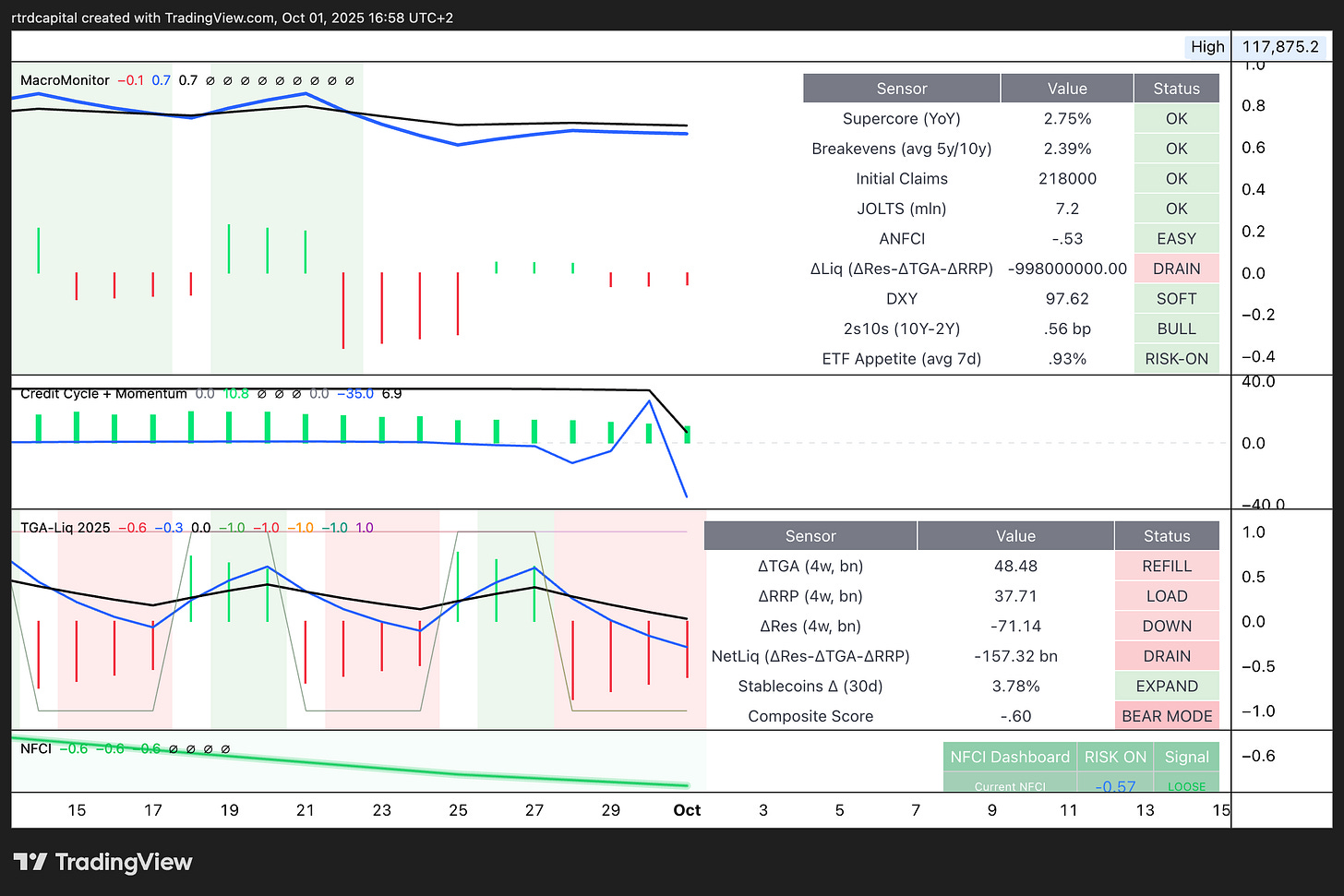

2. Bitcoin Macro Model - macro sensor dashboard

Not a single index - a dashboard of grouped sensors plus a composite Risk-On / Risk-Off read.

Tracked blocks include:

MacroMonitor - ease/tightness: core inflation, breakevens, labor (claims/JOLTS), financial conditions (ANFCI/NFCI), USD, curve, ETF appetite.

Credit Cycle + Momentum - where the credit cycle is and how fast it’s changing.

TGA-Liq / Net Liquidity - the plumbing: TGA, ON RRP, bank reserves, plus stablecoin proxies.

NFCI Dashboard - a dedicated lane for financial-conditions “strictness.”

Right panel: each sensor has a status (OK / EASY / RISK-ON etc). Bottom: composite score + final signal.

How to use:

If Macro Index says “bullish regime” and Macro Model confirms (Risk-On, positive sensors) = green light for “buy-the-dip” tactics.

If the composite drifts to neutral/negative (esp. due to tighter liquidity and rising real rates) = defense mode: cut risk, work the upper half of the FV corridor.

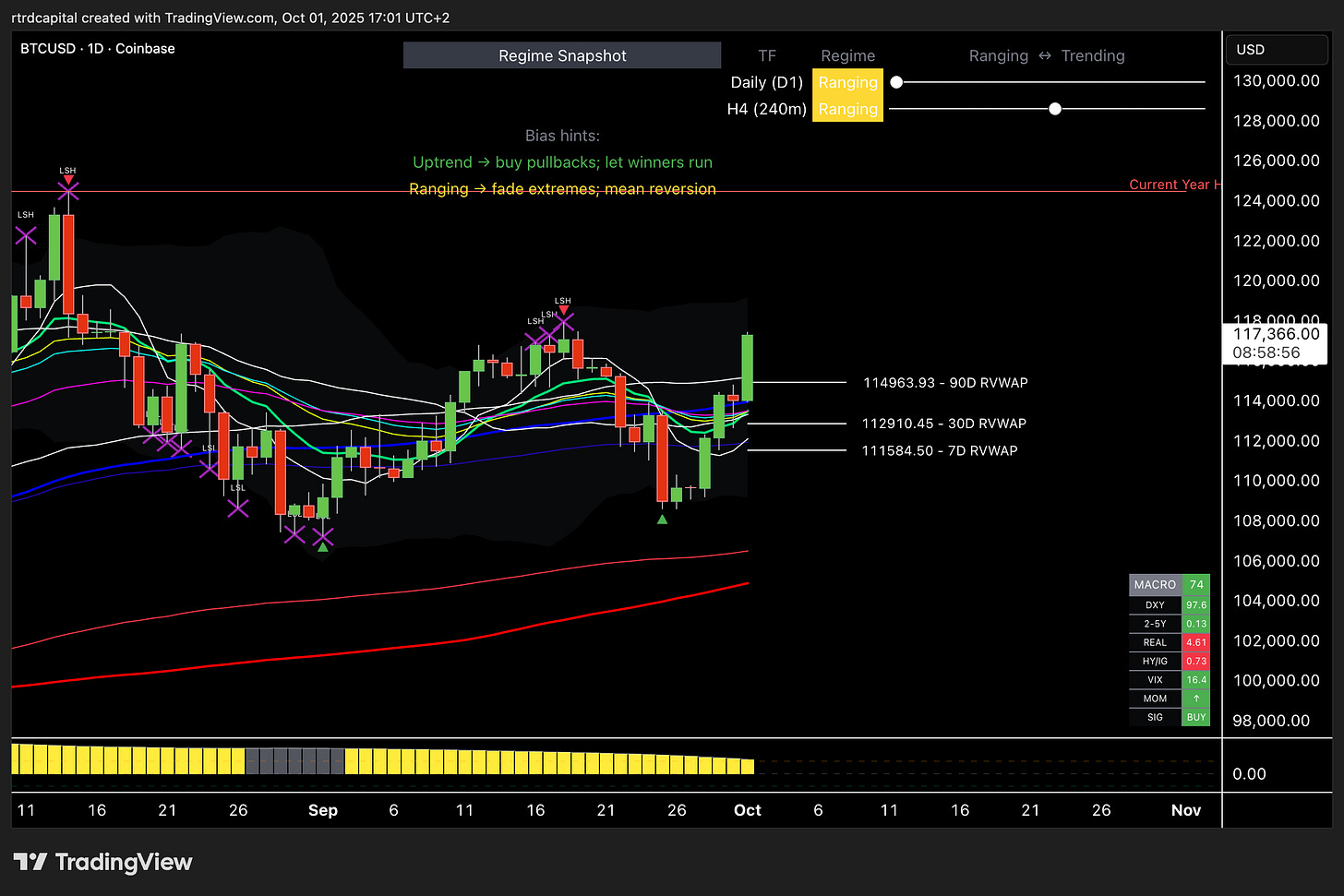

Bitcoin Regime and BTC Macro Index

A composite “macro-climate” oscillator for Bitcoin. It ingests several public factor groups (USD/vol, real yields & curve, Fed/Treasury liquidity, credit spreads, equity risk appetite), normalizes, aggregates, and smooths into one line.On the chart:

Histogram shifts color by regime:

Recovery — rebound from cheap zone (often cycle starts)

Expansion — sustained risk-on (base bull backdrop)

Slowdown — topping, momentum fading

Contraction — risk-off, historically the worst time to add leverage

How to use:

Weekly for cycle; Daily for near-term backdrop.

In Expansion/Recovery: prioritize longs/buy-the-dip. In Slowdown/Contraction: defend PnL, cut exposure, wait for better prices.

Treat it as a filter: it doesn’t pick the entry candle - it tells you direction and appropriate risk.

Why three models?

They answer three different questions:

BTC Macro Index - the climate: is the economy in risk-on or risk-off right now? (use it to filter trade direction and risk size)

BTC Fair Value Model - the valuation: where is BTC’s current fair zone; which levels are logical to buy/trim?

BTC Macro Model - the dashboard: what are the key macro sensors (liquidity, credit cycle, inflation/growth, USD, etc.) saying, and do they confirm the Macro Index?

Together, the trio helps you not fight the backdrop, buy with intent, and take profits when odds fade.