*Bitcoin Signal - weekly institutional-quality reporting and real-time signals for funds, family offices and crypto market professionals.

Hello and congrats to all BTC holders on the new ATH! In this edition, I recap last week and set up the week ahead.

1) Weekly takeaways

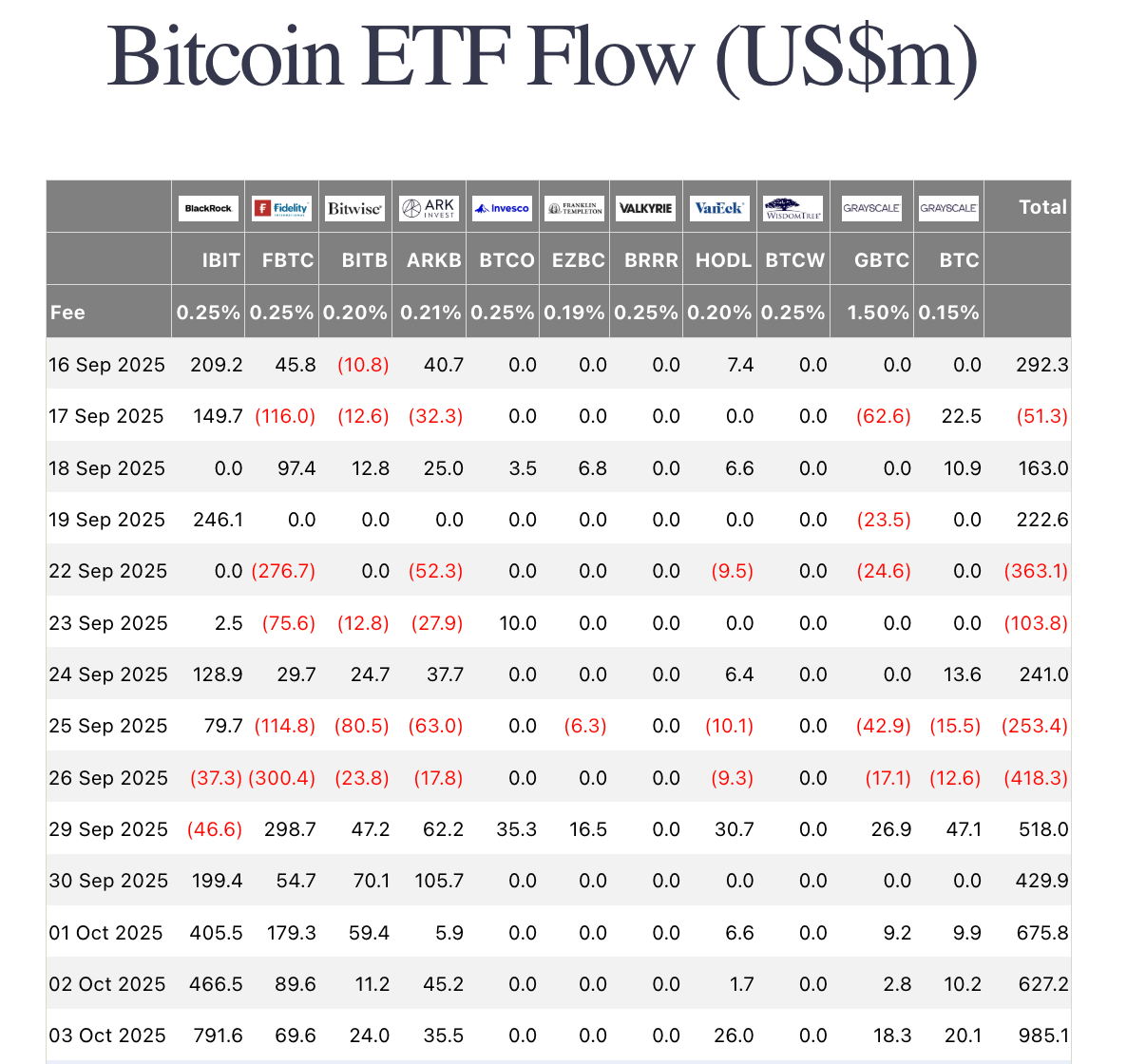

Spot ETF flows: multiple sessions of $0.6–1.0B/day, about $3.2B for the week (Farside). Price pushed into 125.7K, now trading above my Fair Value mid (~123.1K).

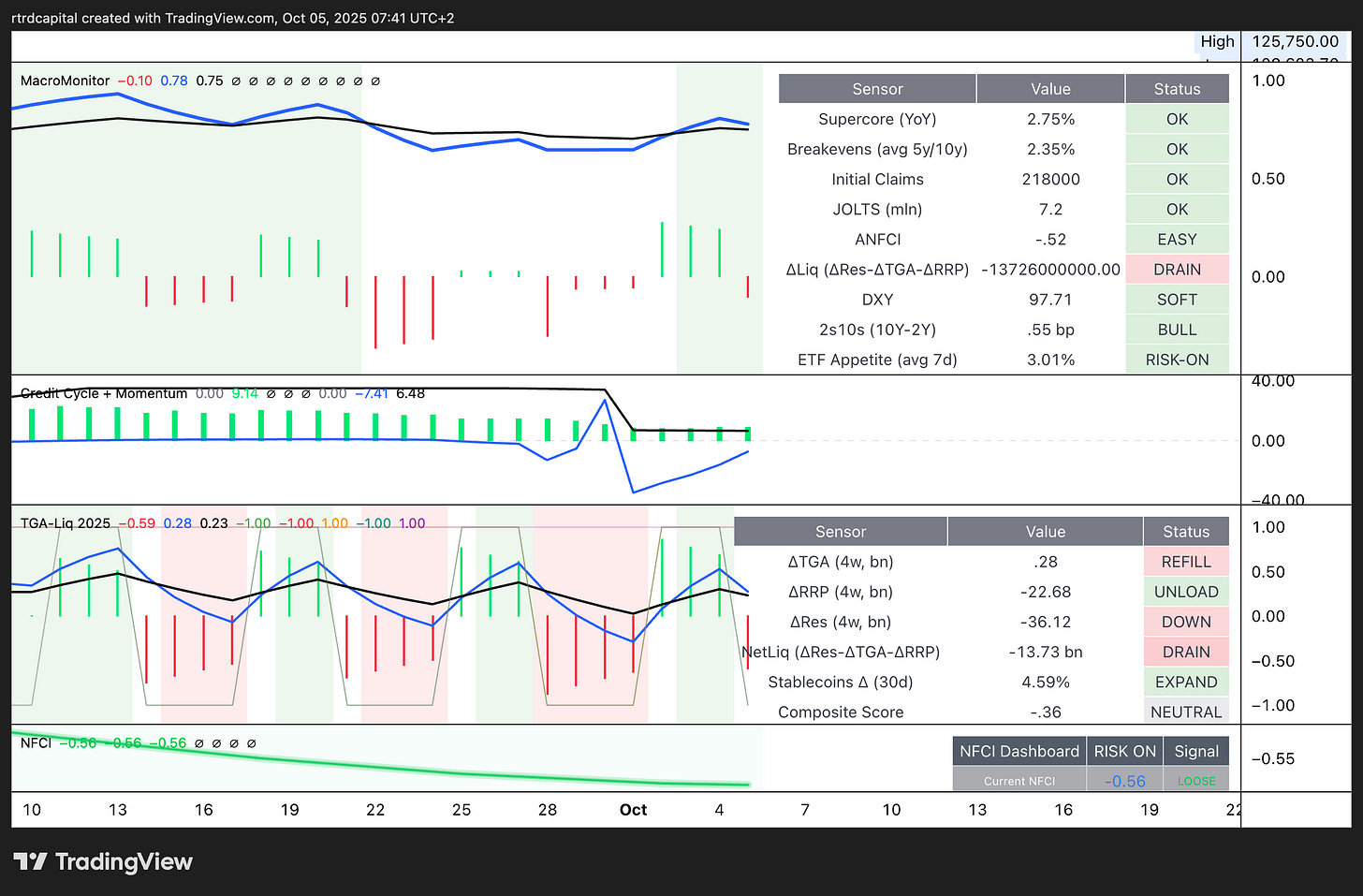

Macro backdrop: the Fed cut 25 bps in September to 4.00–4.25%, and the market prices additional easing in Q4. UST 10Y ~4.10%, DXY ~97.7, VIX ~16.6 — a soft setup that supports risk assets.

Inflation: CPI Aug 2.9% YoY, Core 3.1% YoY; Core PCE Aug +0.2% MoM — moderate disinflation intact.

Uncertainty: the U.S. federal shutdown (since Oct 1) may delay official data, but risk appetite remains firm on easing expectations and ETF inflows.

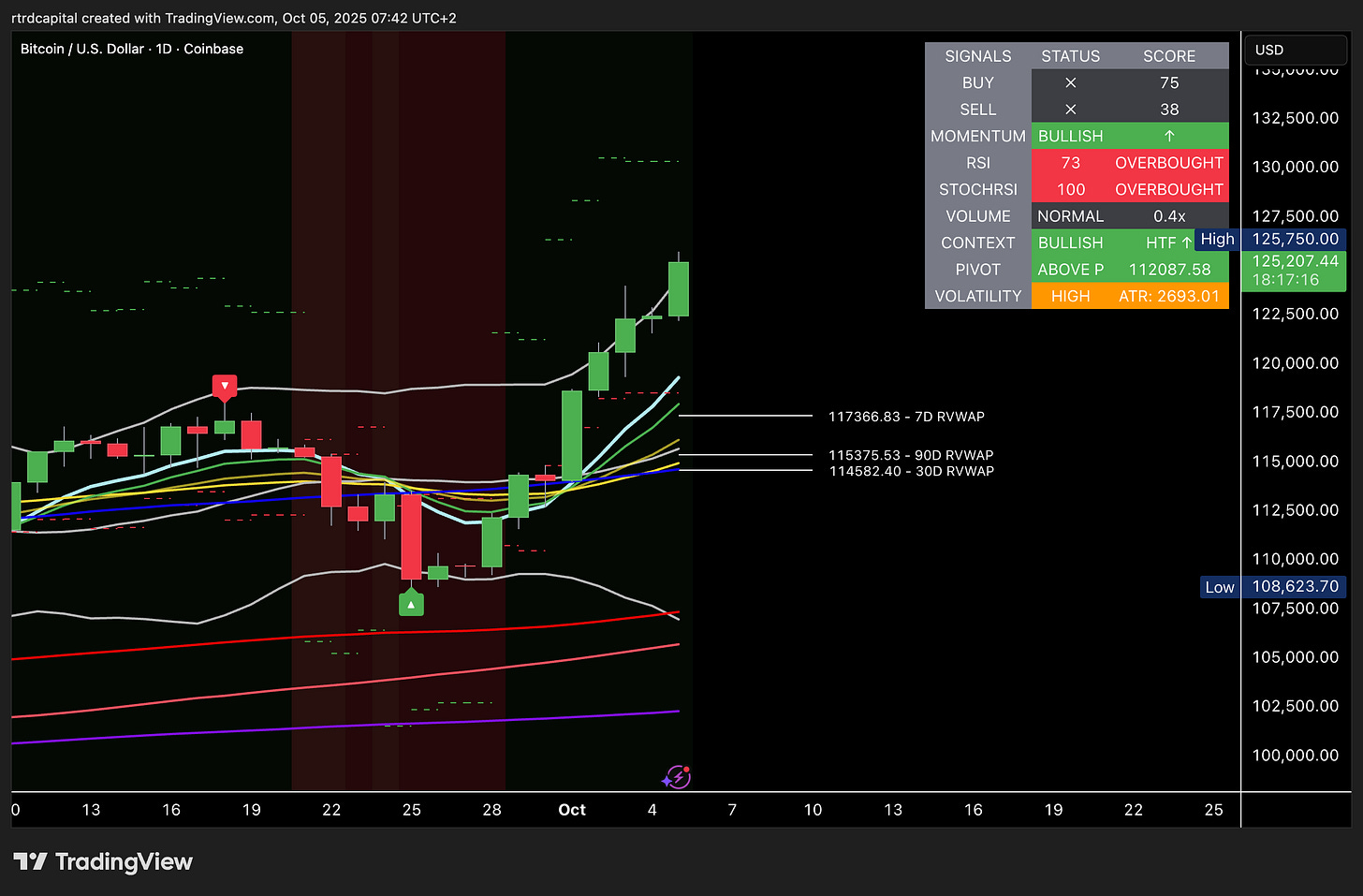

Key idea: over the next 2–6 weeks the base case is sideways-to-up, with likely pullbacks toward 120K and attempts at 127–130K. Near-term, the market is overbought (RSI ~73, StochRSI 100), so the preferred tactic is buying dips rather than chasing highs.

2) Current setup

Regime and momentum

Regime Detector: D1 and H4 = uptrend. Bias: buy pullbacks.

Momentum: bullish, but RSI 73 and StochRSI 100 flag 1–3 days of shakeout risk.

These are the main magnets and reload zones on dips.

The EMA cluster is compressed in 114–118K; above it, the uptrend is confirmed.

Daily ATR ~2.7K — size stops and adds accordingly.

Levels to trade

Resistance: 125.7K (local high), then 127–128K (supply and prior extremes).

Primary support: 120k–117.4K

Deeper support: 115.6–114.6K (90D and 30D RVWAP), then 112.1K (daily pivot), then 107–108K.

Technical takeaway: trend is bullish, price is stretched above MAs and RVWAPs. Typical resolution is a cool-off into ~117–115K or range to refresh oscillators while preserving structure.

3) Flows — spot BTC ETFs

Bloomberg highlights roughly $2B of inflows and a push through $120K on macro triggers.

Stablecoins: our MacroMonitor shows ~+4.6% 30-day growth, historically consistent with crypto-beta liquidity.

Equities/vol: U.S. indices at or near highs, VIX ~16–17 — low vol often rhymes with crypto risk-on.

4) Macro context and liquidity

Policy: the Fed cut to 4.00–4.25% and kept the door open to more easing as labor cools. Futures lean to additional cuts in Oct/Dec.

Rates and USD: UST 10Y ~4.10%, DXY ~97.7 — softer conditions that support risk and “anti-fiat” assets.

Inflation path: CPI/Core and Core PCE are compatible with a gentle easing cycle.

Operating liquidity: our dashboard shows a 4-week net-liquidity drain (ΔRes – ΔTGA – ΔRRP), while NFCI ≈ −0.56 — financial conditions remain easy. The official NFCI for the week to Sep 26 printed −0.56.

Shutdown risk: delays to payrolls and other releases reduce visibility, but for $BTC the channel is “safe-haven/debasement” plus ETF flows.

5) Trading framework

Not advice — a positioning framework within fund risk limits.

Positioning

Hold core long while the daily close is >119K. Preferred expression is buying dips.

Tactical invalidation: daily close <114.5K without a swift reclaim. Strategic: weekly close <112K.

Sizing/leverage: calibrate to ATR ~2.7K. Place stops ~1×ATR beyond the anchor, target 1.5–2.5×ATR. Add on confirmation, not into falling knives.

Daily monitors

Spot ETF inflows/outflows (Farside, Bloomberg).

DXY / UST 10Y / VIX — softness supports upside.

Shutdown headlines and the data calendar for delays that shift Fed expectations.

Disinflation gauges — Core PCE/CPI and breakevens (10Y ~2.3%, 5y5y ~2.3%).

6) Risks

U.S. politics: a prolonged shutdown could weigh on sentiment and liquidity while data visibility deteriorates.

Rates and USD: a jump in DXY back toward 99+ and UST 10Y toward 4.4–4.5% on sticky inflation compresses risk multiples. Watch CPI Oct 15 and nowcasts.

ETF flows: a reversal to net outflows could press price back through 117K.

Conclusion

Base case: maintain a long bias, buy dips toward ~120K, keep a core position, scale partials into ~127K, and let winners run on a break >128–130K.

Switch to defense: on a daily close <114.5K and/or evidence of ETF-flow reversal, reduce exposure.

*This report is analytical in nature and does not constitute investment advice. Risk limits, leverage, and liquidity are subject to the fund’s policy.