*Bitcoin Signal — weekly institutional-quality reporting and real-time signals for funds and crypto market professionals.

Hello! Last week we were celebrating ATH, and this week we’re in turmoil after massive liquidations that hit the crypto market following new headlines about Trump’s tariffs against China.

US Tariffs Against China. President Donald Trump announced 100% additional tariff on a wide range of Chinese goods (effective November 1, 2025), sharply escalating the trade conflict.

China’s Response. Beijing publicly criticized the new tariffs and, amid existing rare earth export restrictions, accused the US of escalation. Reuters

Crypto Market Liquidations. The next day, markets experienced the largest derivatives liquidation wave ever: per CoinDesk/Coinglass — ≈$19B total, accompanied by sharp BTC price collapse. Multiple outlets confirm the “record” liquidation scale.

This “geopolitics + derivatives avalanche” combo became the immediate trigger for BTC’s fall from 122k to 107k with subsequent bounce to 111k.

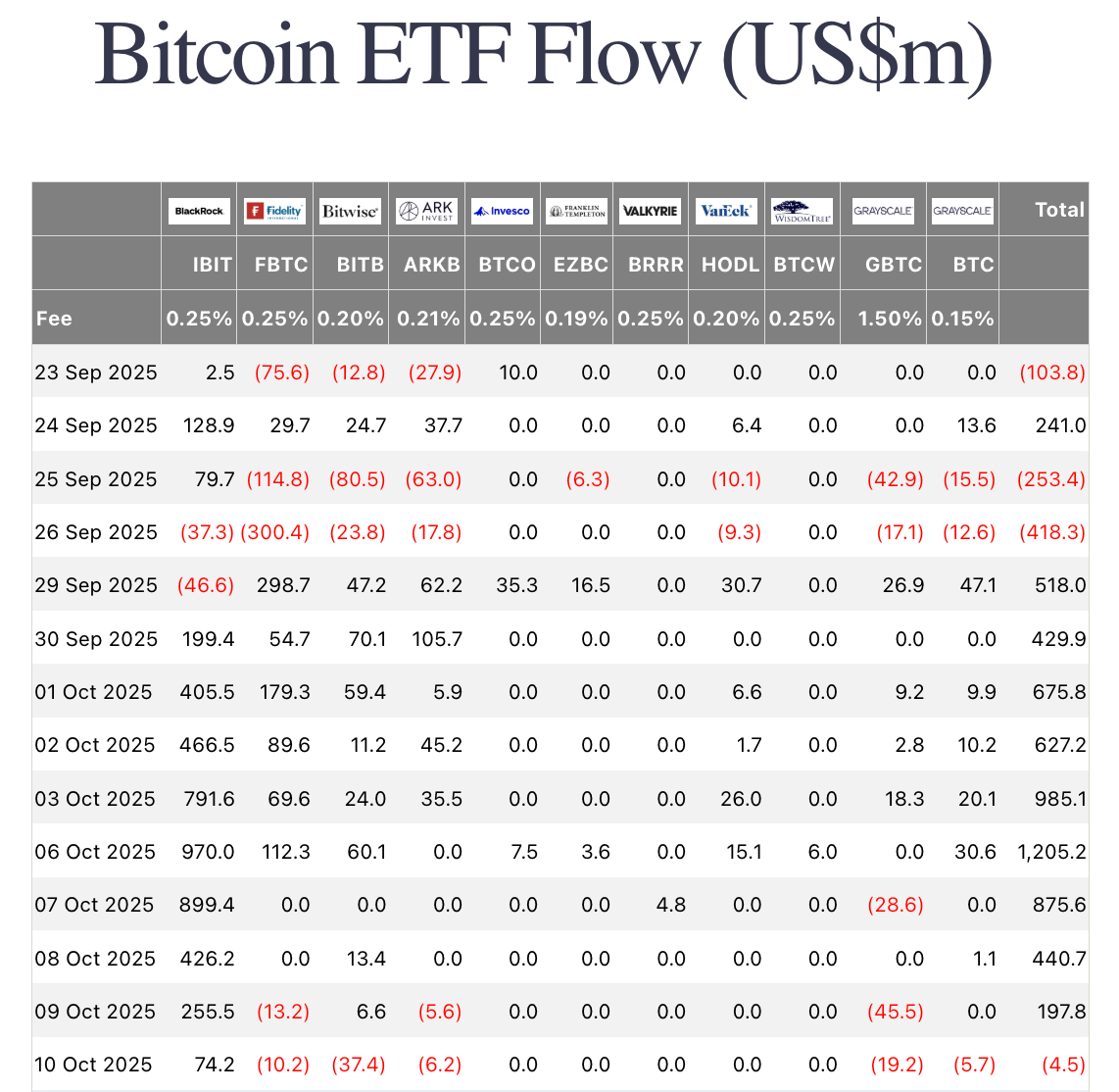

BTC-ETF:

We observed large ETF inflows almost all week and as often happens, correction follows after inflows above 900M. You can identify a pattern - buy when there’s a series of outflows and sell when ETF has huge inflows.

Bitcoin Fair Value Model:

This indicator was very effective in late August and earlier in April for identifying bottoms and good entry points for intraweek positions.

Currently there are no clear buy signals for BTC, only potential signs (light green circles under candles), but need to wait for a clear signal. Fair value based on this indicator is now $122,190.

BTC Regime Model:

Regime Snapshot:

D1 - Uptrend, H4 - Ranging: medium-term bullish, short-term - phase consolidation/redistribution after shock.

Momentum Signals: Signals block - Momentum: Bearish ↓, RSI ~40 (neutral-weak), StochRSI ~4 (oversold), ATR ~3716 - volatility elevated, short-squeeze/technical bounces likely, but trend acceleration up difficult while downward momentum not fully exhausted.

Key Prices and Supports:

Resistance:

118,624 — 7D RVWAP

115,542 — 30D RVWAP, 115,531 — 90D RVWAP (dense cluster, range “ceiling”)

Support:

112,538 — dYear VAH (last year’s value area high; currently tested from below)

107,000 — local shock candle low (LSL)

100,196 — dYear VWAP (key yearly “average”)

96,084 — 365D RVWAP (long-term yearly “lifeline”)

Conclusion: Control shift to sellers - losing 112.5k (dYear VAH) and dropping below 30/90D RVWAP turned 115-118k into main “ceiling”. Until this cluster reclaimed, all bounces considered reactive.

Oscillators provide “window” for reflex: StochRSI≈0-10, RSI≈40 = high chance of technical bounce in 1-3 days to 112.5k-115k, where counter-supply will be tested.

Structural support 107k: shock candle minimum + local stop liquidity. Clean daily/weekly break of 107k opens 100.2k (dYear VWAP) and ~96k (365D RVWAP).

ATR ~3.7k: tactics - work from supports/range boundaries, calibrating stops at 0.8-1.2×ATR beyond level.

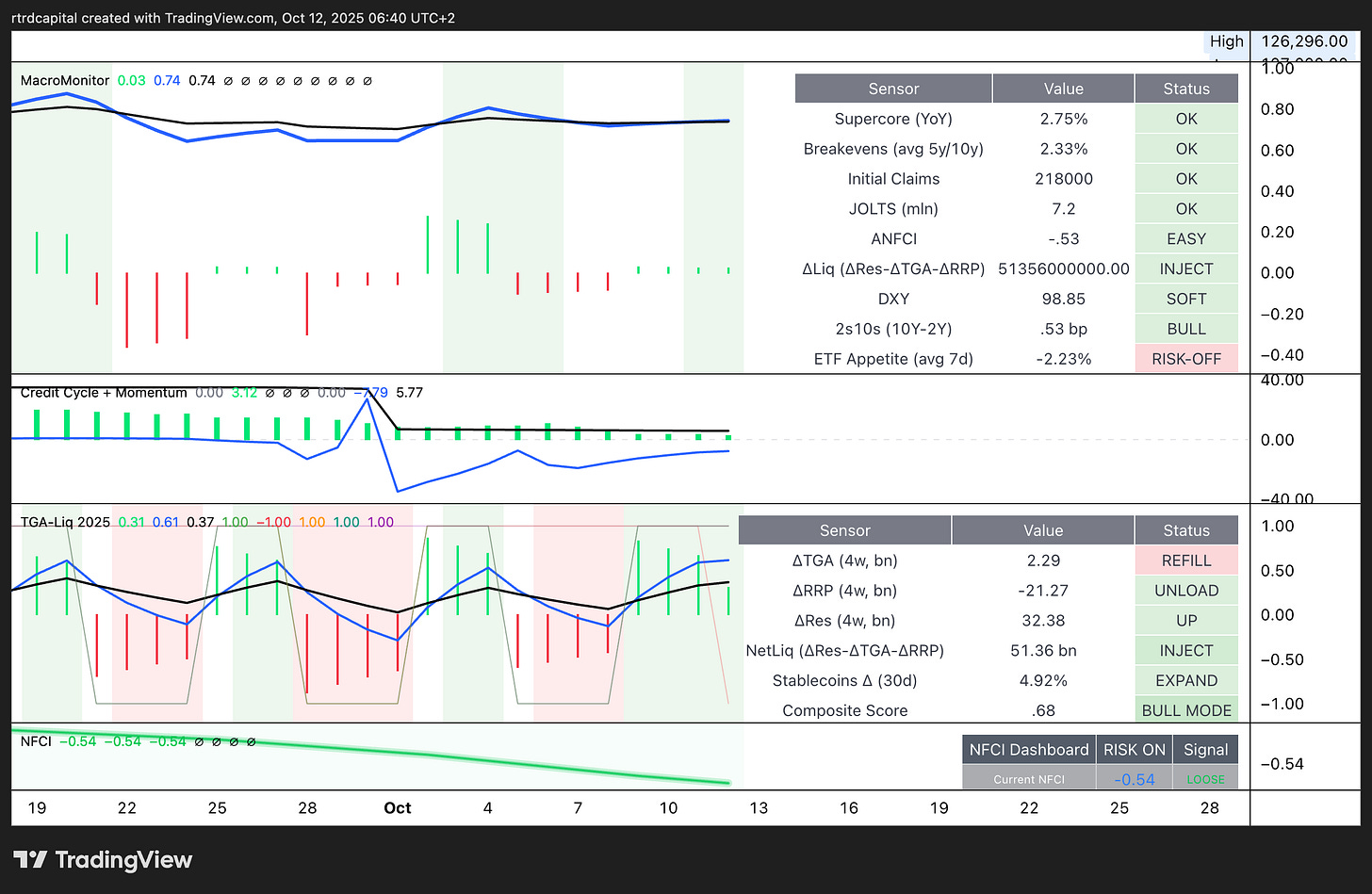

Macro Model

DXY ~98.85 - relatively high dollar = headwind for beta. VIX ~21.6 - elevated uncertainty regime (yesterday’s spike). Real rates ~3.75% - remain tight but not accelerating.

NFCI ~−0.54 (LOOSE) - financial conditions remain soft despite vol spike.

ΔNetLiq (ΔRes−ΔTGA−ΔRRP) ~+51.4B - INJECT, stables 30d ~+4.9% (EXPAND) - systemic liquidity supports “buying dips”, though ETF appetite 7d ~−2.23% (RISK-OFF) signals temporary flow fatigue.

Risk Calendar: Despite shutdown, BLS confirmed September CPI release October 24; then FOMC October 28-29. Two nearest “dated” risk points.

Bottom line: fundamental liquidity not destroyed, but tariff news risk and short-term shock regime (DXY↑/VIX↑) require patient “buy-the-dip”, not chasing price.

Likely Scenario:

Consolidation with return above 112.5k and test of 115-118k

Conditions: news background without new tariff escalation/countermeasures; DXY stabilizes <99; VIX returns to 18-19.

Successful hold above 118.6k (7D RVWAP) returns uptrend on D1.

Overall Summary

Medium-term bull framework not broken, but market must reconquer 112.5k and 115-118.6k cluster. Until then, trade from levels, buy confirmed pullbacks, not chase price. On clean 107k break, prepare for 100-96k as stress-liquidity zone and likely emergence of “long-term” capital.

*This report is analytical in nature and does not constitute investment advice. Risk limits, leverage, and liquidity are subject to the fund’s policy.