Bitcoin Signal #3

Hey! Another tough week in the books, let’s recap and set the plan for next week.

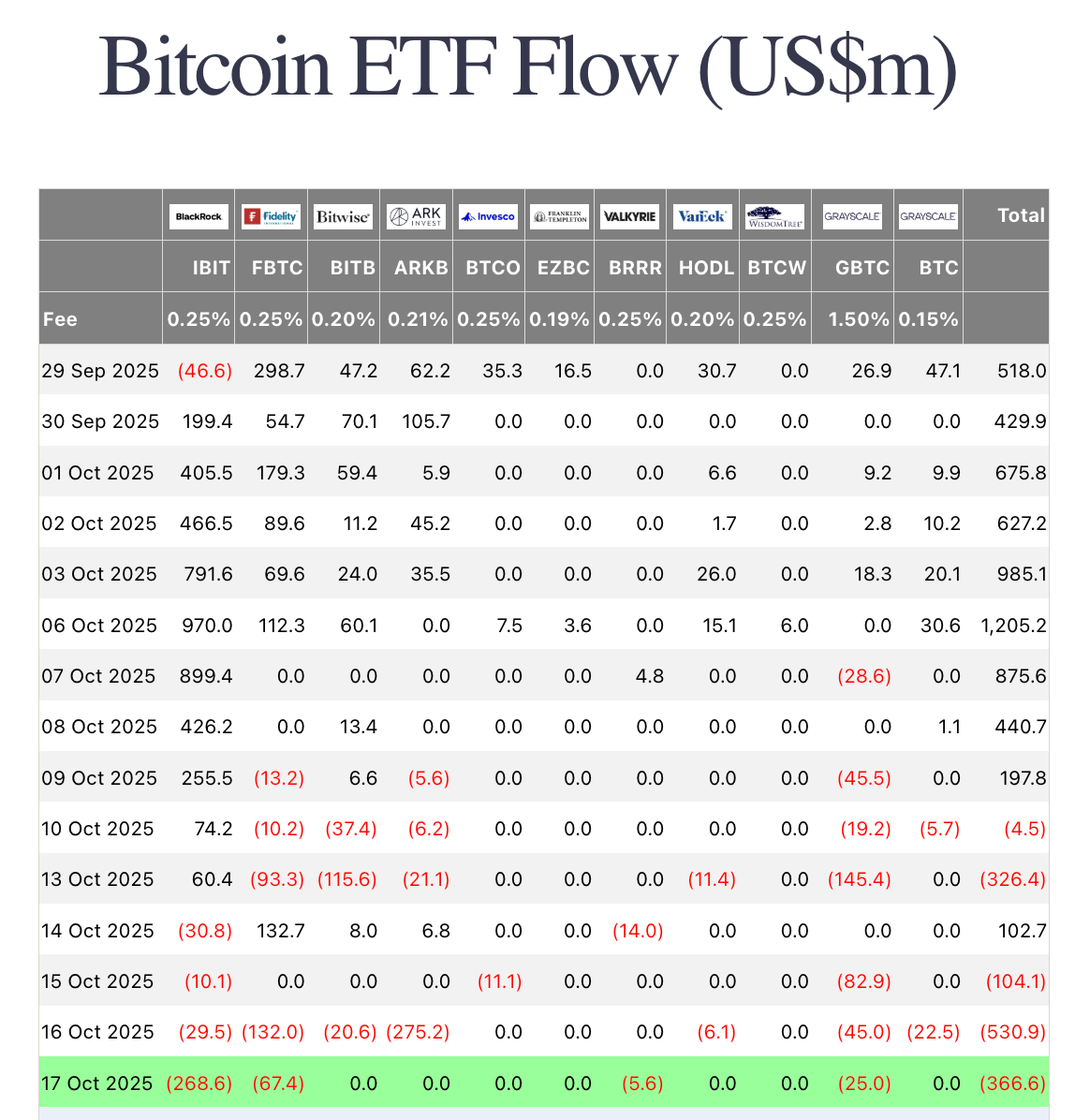

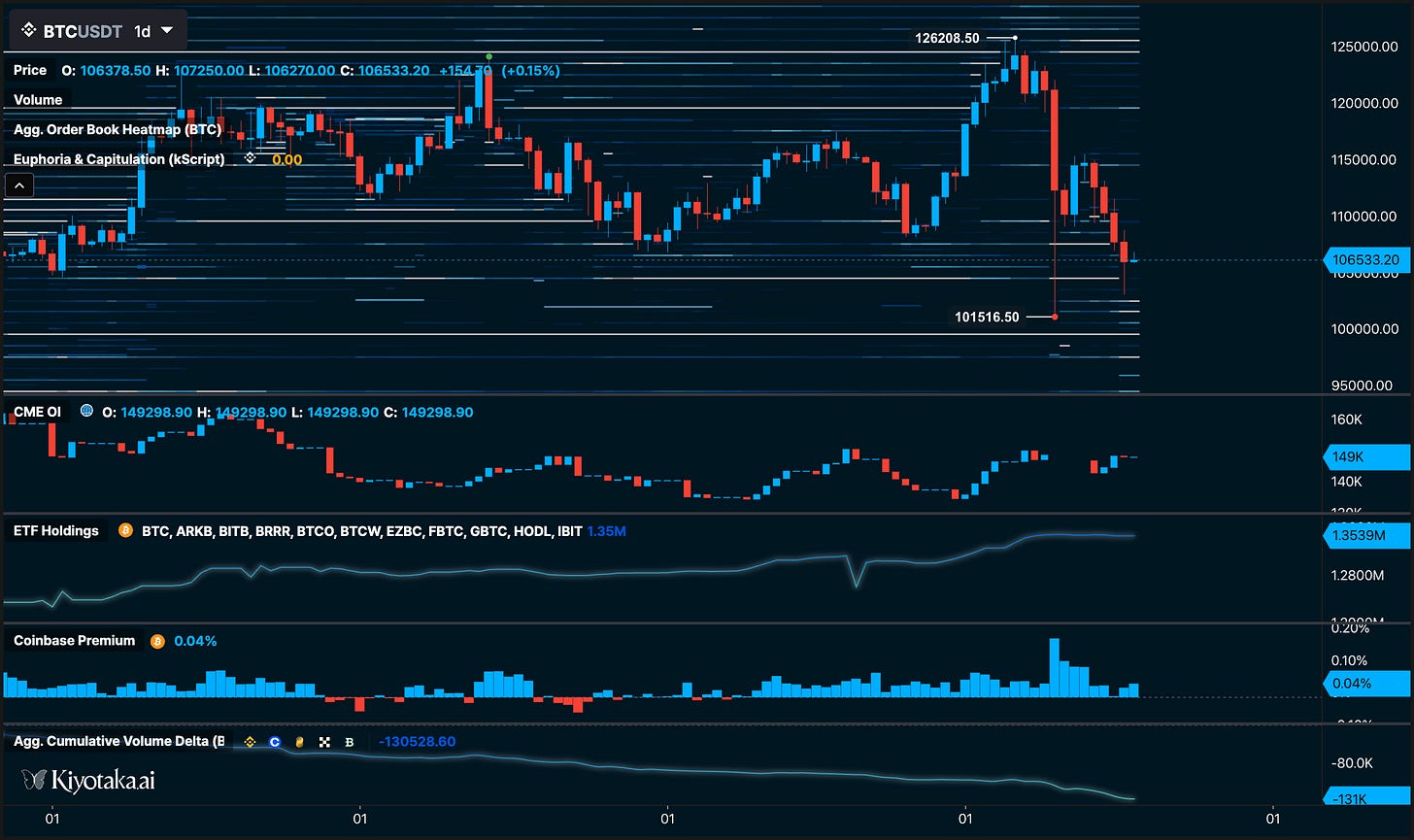

BTC is in a clear downtrend, as signaled by my Regime indicator. Yesterday BTC dumped to 103,500 but bounced back above 106k pretty quickly after Trump calmed the markets, saying “WE’LL BE FINE WITH CHINA.” That said, the DXY is still elevated at 98.5 and VIX spiked above 25 during the day, it’s sitting at 20 now, which is still pretty high and signals risk-off sentiment. We’ve also seen three consecutive days of BTC ETF outflows, with Thursday being especially brutal at -530M. And like I’ve said before, this entire cycle depends on institutional buying. Without ETF inflows, Bitcoin isn’t moving higher. We’ve seen this play out countless times, remember early October when price pumped to 126k? That was on consistent daily inflows.

Charts

BTC trades below key 1D levels: 108K (EMA200) and 107.3K (SMA200). If we don’t reclaim >108K soon, I’ll look for 101.7K (1W SMA50), lose that and it’s 100–96K. Likely the drop finishes at one of these spots, then a quick return toward 112K.

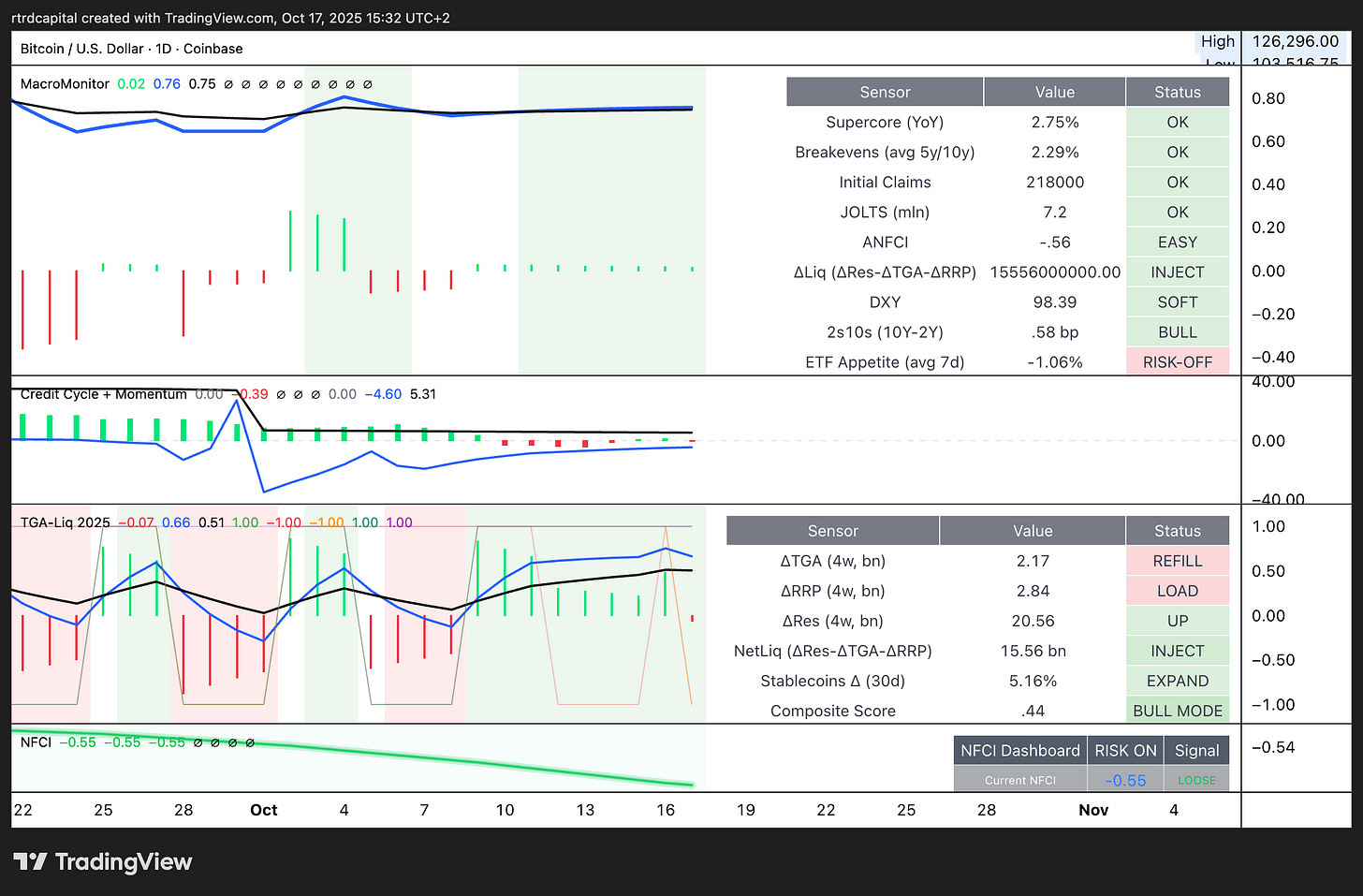

Liquidity / Macro

My Macro Model shows a net-liquidity injection (NetLiq +$15.6B), stablecoins +5.1%/30d, and a steepening 2s10s. But ETF appetite = risk-off, muting impulse. NFCI < 0 (LOOSE) - financial conditions remain easy.

OE Score prints an “extreme buy”: structure is oversold on relative metrics and biased to mean-revert if 101.7K holds.

Checking Kiyotaka, we see solid support at 100k with 535 BTC in spot limit orders. Coinbase Premium is in the green, US buyers are still accumulating on the dip on CB. But here’s the thing: spot CVD (bottom line) is rolling over, which tells us the selling is coming from spot sales, not just futures shorting.

Bottom line

I don’t think a bear market has begun. We’re seeing tariff-headline panic, but macro structure hasn’t broken. We also have US–China talks late October and an FOMC where a cut is likely. I’m still buy-the-dip in 101.7K–96K, that zone likely forms the low. A sustained reclaim >112K opens $115–116K.

My fair value model is also screaming that BTC is deeply oversold right now. Fair value is tracking at 122,100, and today we finally got a buy signal.

Take Profit: 122,100 Stop Loss: 98,600

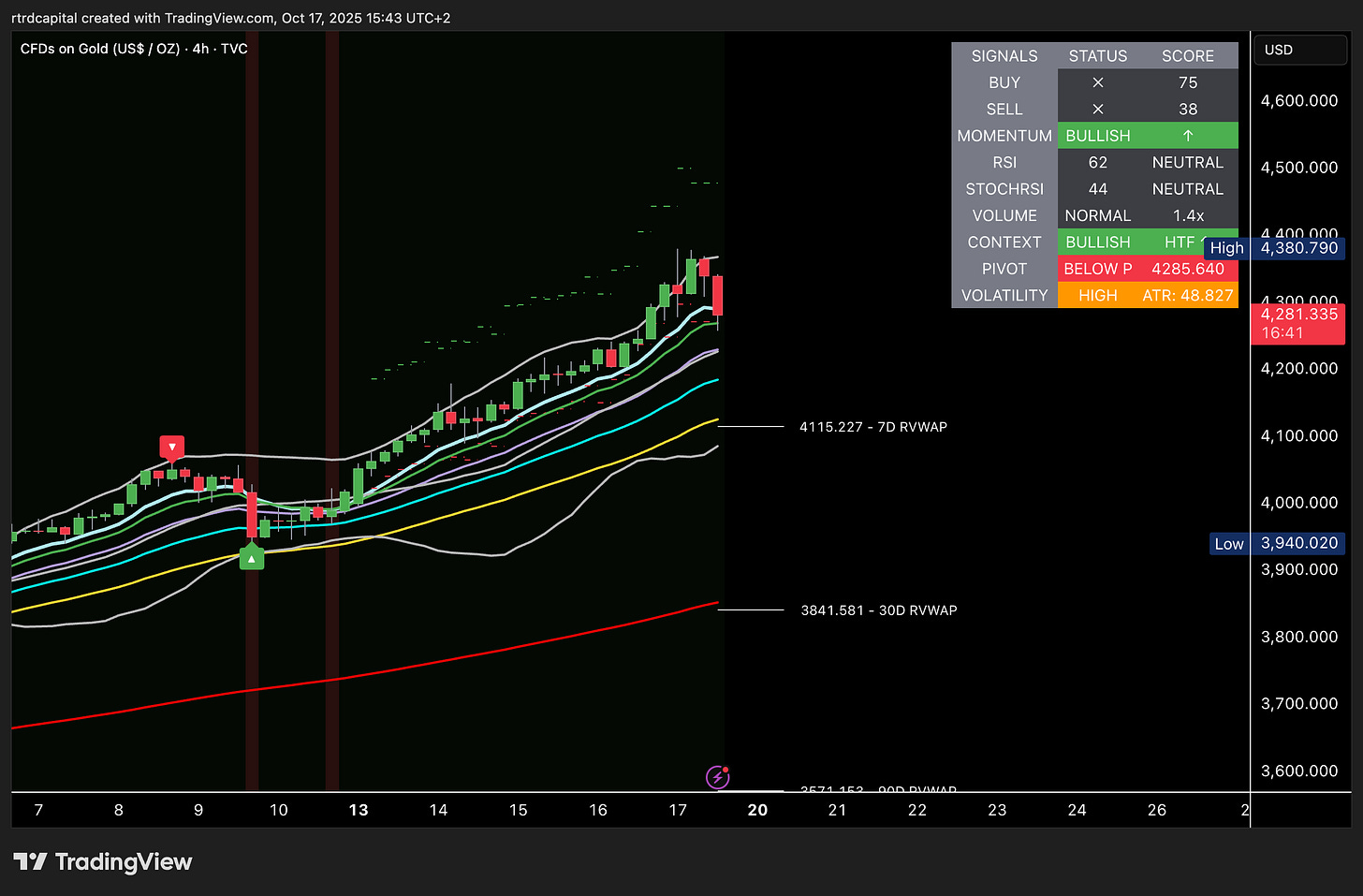

We’re also seeing gold starting to roll over after being overbought on higher timeframes. We should expect a rotation out of gold and into BTC as a beta asset soon, so right now is definitely not the time to be bearish on Bitcoin.