Introduction to my Bitcoin Macro model

Which phase are we in right now, and what should we expect next?

Model Takeaways

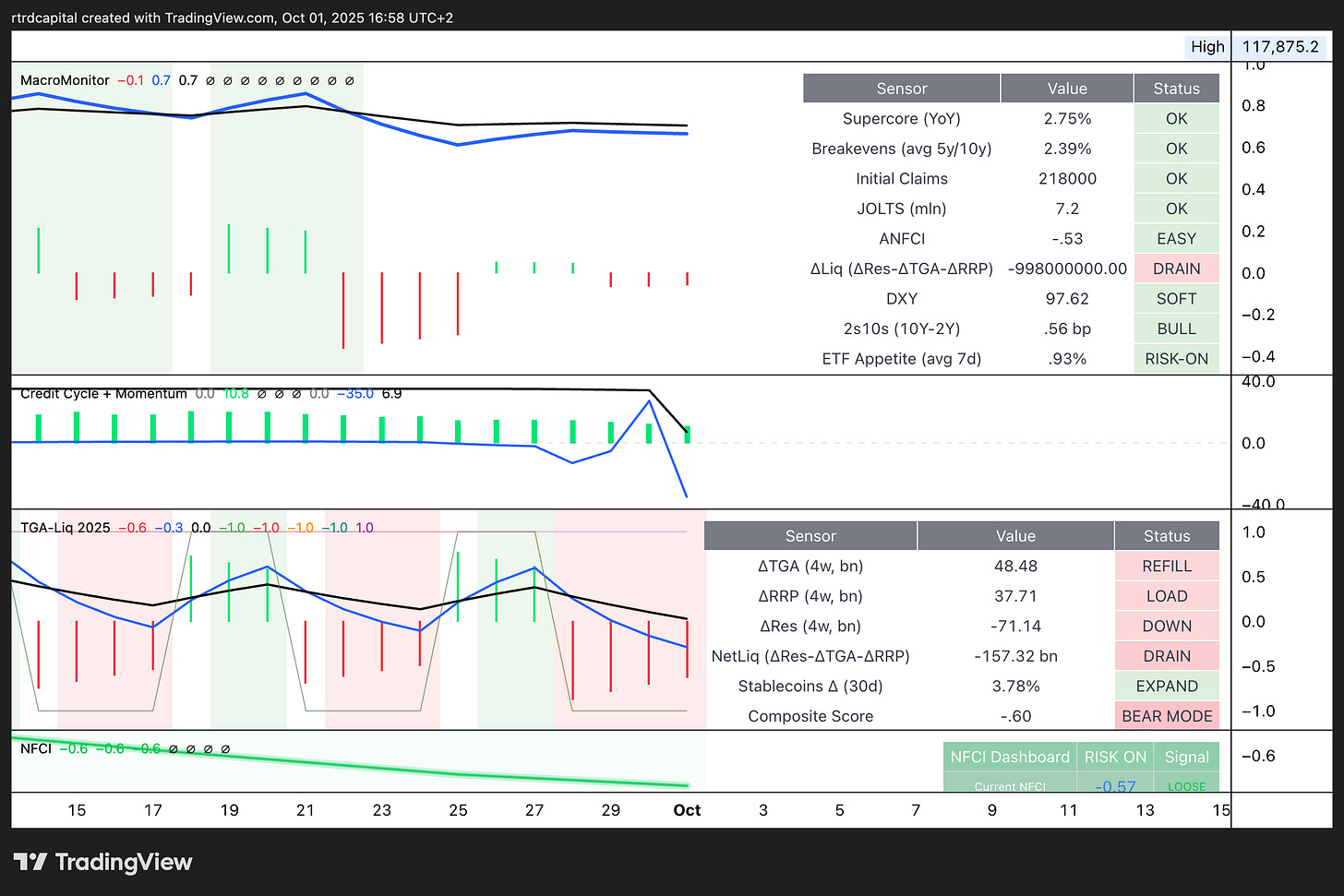

The framework flags a neutral–bearish tactical backdrop: supportive macro and a softer dollar keep risk afloat, and the credit cycle is accelerating. But liquidity drains from Treasury/RRP/reserves and waning ETF appetite offset those positives.

Where We Stand

Macro Monitor — Neutral.

Core inflation and breakevens remain in a comfortable band; labor markets are softening but not “breaking.” A weaker dollar and a steeper curve are risk-friendly. But ETF appetite is firmly risk-off, dampening capital inflows.

Credit Cycle + Momentum — Positive Tilt.

The green histogram is expanding, Sensitive (blue) is holding above zero, Cyclical (white) maintains an upward gradient. Net impulse = pro-growth, without signs of overheating.

TGA Liquidity — Bear Mode.

Aggregate liquidity (TGA, RRP, reserves) is in drain mode; composite < 0. Rising stablecoin supply helps, but not enough to flip the regime.

Base Case (7–21 days)

An upward-leaning range if flows improve. If liquidity drainage slows and ETF appetite shifts to neutral/positive, credit impulse can pull markets back into trend. Probability ≈ 60%.

Risk Case

Persistent liquidity drain + entrenched ETF risk-off - deeper consolidation/correction in BTC. Probability ≈ 40%. Expect heightened sensitivity to negative headlines and volatility spikes.

Bullish Triggers (What I’m Watching)

Net-liquidity composite climbs out of negative into flat/positive.

ETF appetite shifts from risk-off → neutral at minimum.

Credit Cycle Sensitive (blue) holds above zero and converges toward/exceeds Cyclical (white).

Continued stablecoin expansion confirming on-chain monetary impulse.

Downside Anchors

Prolonged liquidity drain (TGA rebuilding faster than RRP/reserves unwind).

Sustained ETF outflows.

Weakening on-chain pulse without offset from derivatives.

Bottom Line

The model says: momentum is here, but fuel is scarce. The credit cycle is leaning bullish, yet liquidity is the constraint. The next meaningful move won’t come from price action alone, but from a regime shift in flows. Once the drain abates and ETF demand normalizes, odds of trend resumption rise sharply.