Why the Bitcoin bull cycle isn’t done, and why late-2025 and 2026 still skew up

Markets don’t run on textbooks, they run on money flows. On that metric, the Bitcoin cycle hasn’t peaked. Tariff headlines are noise; the signal is a still-benign liquidity backdrop: global liquidity is expanding, the Fed is pivoting toward easier policy, the TGA drainage impulse is fading, and the “debasement trade” is rotating from gold into higher-beta expressions — Bitcoin.

1) Global liquidity is still rising, and BTC is the release valve

In the CrossBorder framework, ~50% of BTC’s systematic moves are explained by global liquidity; the long-run correlation with broad money is near unity.

The “10-50” rule still applies: +10% in global liquidity ≈ +50% in BTC (constrained supply + high beta to flows).

2023–2025 saw a synchronized easing bias: the PBoC resumed injecting liquidity, the BoJ kept funding costs pinned, and the Fed drifted from QT hardness to neutrality. Net: there’s more money in the system, and excess money migrates to the furthest point out the risk curve.

Translation for allocation: as long as the global liquidity aggregate is rising, BTC remains a prime beneficiary, that’s plumbing, not narrative.

2) The policy pivot: cheaper money, stronger demand for beta

Inflation cooled, labor markets normalized — the window for rate cuts is open. Falling real yields down = lower “price of money” = higher risk premium for BTC.

The cash wall is huge (trillions parked in money funds). As real yields slip and front-end rates roll over, that cash gets pushed out into beta assets.

Cuts also lift money supply (mechanically), which is what BTC trades. The first hints of easing already coincided with a fresh up-turn in global M2, and with it, a resumption of BTC’s up-trend.

Not just the Fed. The ECB is on pause; China has eased RRR and credit conditions for over a year. Synchronized policy softness amplifies the global liquidity pulse. Historically, in easing regimes (2019, 2020), BTC behaves like the high-beta beneficiary of monetary expansion. Expect the same playbook.

3) The TGA drag is ending — bank reserves stop bleeding

2023–2024’s stealth tightening came as Treasury rebuilt the TGA, issuing size and draining bank reserves alongside QT. That impulse is now largely spent.

With TGA near target and issuance skew normalizing, net reserve leakage abates. Absent fresh drains, fiscal cash flows (taxes, coupons) recycle more cleanly into the private sector rather than parking at Treasury.

The Fed has already shown a bias to avoid reserve scarcity as money market plumbing tightens, another way of saying the official sector is pivoting from subtracting to not subtracting liquidity.

Bottom line: the “two-handed” squeeze (QT + TGA rebuild) is fading. That turns a headwind into a cross-wind, and for BTC, into a tail-wind when combined with rate cuts.

4) Rotation: from gold to Bitcoin — the high-beta leg of the debasement trade

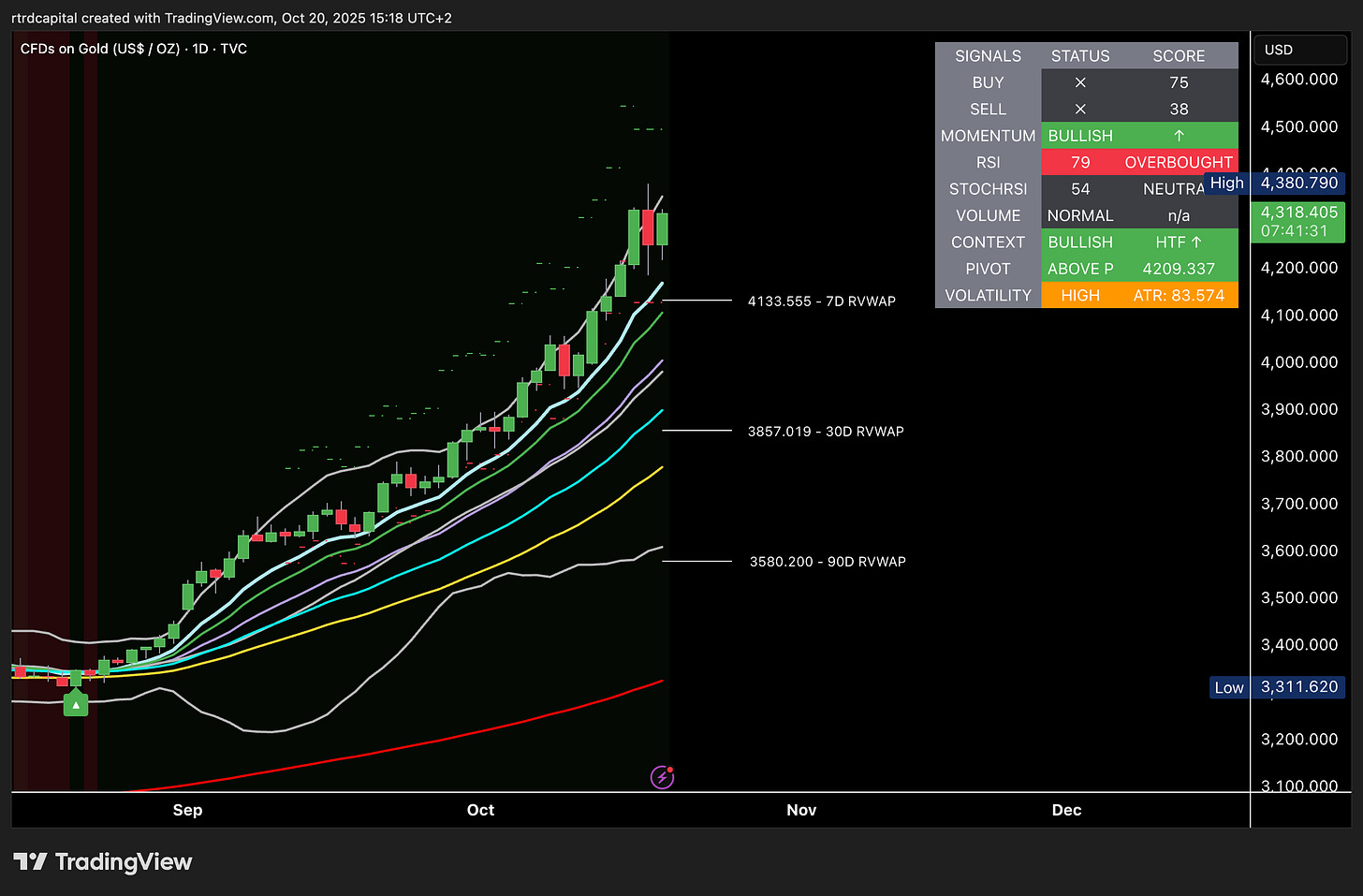

The debasement trade started in gold and is now bleeding into higher-beta stores of value. Gold made the first move on policy inertia and geopolitical risk; BTC often lags then catches up.

As Michael Howell notes, in the short run gold and BTC can be negatively correlated (flight to safety vs. risk appetite); over the cycle they converge, spikes in gold typically elicit a follow-through in Bitcoin.

With policy turning supportive and fear receding, capital rotates out of the defensive leg (gold) into the offensive leg (BTC) to capture higher convexity. BTC’s sensitivity to liquidity is multiples of gold’s.

Positioning tell: gold’s run pulled forward the “insurance” leg. The next marginal dollar of the debasement trade typically reaches for beta, and that’s Bitcoin.

5) Financial repression is policy, not a bug — BTC is the hedge with torque

The fiscal math is inescapable: big deficits, aging debt stock, political constraints on austerity the only workable restructuring is currency debasement.

In Howell’s words, this era is historically unique — a 4,000-year rate history had no precedent for such sustained repression. Policy makers can’t tax meaningfully more; they can’t slash spending; they monetize.

Repression means inflation above policy rates over time. That silently taxes savers and rewards debtors, and pushes capital into scarce assets. Gold benefits. BTC benefits more because it is the high-beta conduit for excess liquidity.

Interpretation: BTC is becoming the index of financial repression. The more persistent the debasement, the stronger the strategic bid for a hard, non-dilutive asset with growth optionality.

Conclusion. If you believe the world is in a protracted monetary debasement regime, you don’t fade the release valve. Liquidity is still trending up, policy is turning easier, the TGA drain is behind us, and the debasement trade is rotating from defense to beta. The recent pullback on tariff headlines is signal-to-noise dilution. The cycle isn’t over; it’s reloading for the late-2025 leg and a carry into 2026.